FAQ: Getting reimbursed

How do I claim for medical expenses that I have already paid for to my medical provider?

1

3

Don’t forget: you must submit your claims within the claiming deadline set out in your Benefit Guide.

Quick claim processing

Once we have all the information required, we can process and pay a claim within 48 hours. However, we can only do this if you have told us your diagnosis, so please make sure you include this with your claim. Otherwise, we will need to request the details from you or your doctor. We will email or write to you to let you know when the claim has been processed.

Understanding insurance terms

Which exclusions are applicable to my plan?

Limits / Deductibles / Co-payments

Moratorium and Full Medical Underwriting

What is in-patient, out-patient and day care treatment?

Please note that important terms and conditions are applicable to the medical claiming process. These terms and conditions may vary depending on the product available to you and on the type of insurance contract. We therefore advise you to check your Benefit Guide to confirm the claiming terms and conditions applicable to your policy with us.

You can access your Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and select the “Documents” tab.

For convenience, we summarise below the terms and conditions that normally apply to standard policies in terms of medical claims:

- You must submit all claims (via our MyHealth digital services) no later than six months after the end of the Insurance Year. If cover is cancelled during the Insurance Year, you should submit your claim no later than six months after the date that your cover ended. After this time we are not obliged to settle the claim

- You must submit a separate claim for each person claiming and for each medical condition being claimed for.

- When you send us copies of supporting documents (e.g. medical receipts), please make sure you keep the originals. We have the right to request original supporting documentation/receipts for auditing purposes up to 12 months after settling your claims.

We may also request proof of payment by you (e.g. bank or credit card statement) for medical bills you have paid. We advise that you keep copies of all correspondence with us as we cannot be held responsible for correspondence that fails to reach us for any reason outside of our control.

- If the amount you are claiming is less than the deductible figure in your plan, you can either:

- Collect all out-patient receipts until you reach an amount that exceeds this deductible figure.

- Send us each claim every time you receive treatment. Once you reach the deductible amount, we’ll start reimbursing you.

Attach all supporting receipts and/or invoices with your claim.

- Please specify the currency you wish to be paid in. On rare occasions, we may not be able to make a payment in that currency due to international banking regulations. If this happens, we will identify a suitable alternative currency. If we have to make a conversion from one currency to another, we will use the exchange rate that applied on the date the invoices were issued, or on the date that we pay your claim. Please note that we reserve the right to choose which currency exchange rate to apply.

- We will only reimburse (within the limit of your policy) eligible costs after considering any Pre-authorisation requirements, deductibles or co-payments outlined in the Table of Benefits.

- We will only reimburse charges that are reasonable and customary in accordance with standard and generally accepted medical procedures. If we consider a claim to be inappropriate, we reserve the right to decline your claim or reduce the amount we pay.

- If you have to pay a deposit in advance of any medical treatment, we will reimburse this cost only after treatment has taken place.

- You and your dependants agree to help us get all the information we need to process a claim. We have the right to access all medical records and to have direct discussions with the medical provider or the treating doctor. We may, at our own expense, request a medical examination by our doctors if we think it’s necessary. All information will be treated confidentially. We reserve the right to withhold benefits if you or your dependants do not support us in getting the information we need.

a. If you are under one of our standard International Healthcare Plans, the general claiming procedure described in these FAQs will apply to most treatments. However we may ask you to submit additional documents (i.e. Medical reports or prescription) when claiming for certain benefits.

When is a medical report needed?

You will be asked to attach a medical report when you claim for:

- Doctor’s Visit - Psychiatry Consultation

- Doctor’s Visit - Psychotherapy Consultation

- Doctor’s Visit - Cancer Consultation

- Doctor’s Visit - Speech Therapy

- Doctor’s Visit - Oculomotor Therapy

- Doctor’s Visit - Occupational Therapy

In addition, you’ll also be asked to provide a medical report, X-rays and your treatment plan when claiming for orthodontic treatment.

When are prescriptions needed?

You will be asked to attach your prescription when you claim for:

- Medication and Medical Aids - Medication

- Medication and Medical Aids - Maternity Medication

- Medication and Medical Aids - Vitamins and minerals

- Medication and Medical Aids - Cancer Medication

- Optical - Contact Lenses

- Optical - Glasses

- Maternity Expenses - Maternity Medication

- Cancer Treatment - Cancer Medication

When is a Tax invoice needed?

We will need a tax invoice to process your claim if the treatment you are claiming for took place in China, Brazil or Italy. This tax invoice is the “Fa Piao” in China, “Bollo” in Italy and “Nota Fiscal” in Brazil. But don’t worry – we will let you know if these are required when you submit a claim on MyHealth app or portal.

b. What do I need to consider when claiming for maternity expenses?

The claiming procedure applicable to your policy will be described in your Benefit Guide.

If you are under one of our standard International Healthcare Plans, the general claiming procedure described in these FAQs will apply to pre-natal care claims too, where pre-natal care is included in your cover.

For the delivery, however, you will need to obtain our pre-authorisation via submission of a Pre-authorisation Form (available here). Please complete and submit it 4-6 weeks before the estimated delivery date to allow our Medical Team to confirm cover and arrange for direct billing (where possible) with your medical provider of choice.

In case of an emergency, don’t worry: just obtain your medical assistance and call us within 48 hours of the emergency, to inform us of the hospitalisation. We can get the Pre-authorisation Form details over the phone when you (or your medical provider, or a family member – if you are unavailable to talk on the phone) call us.

Please note that we may decline your claim if Pre-authorisation is not obtained: full details of our Pre-authorisation process can be found in your Benefit Guide.

You can access your Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and select your Benefit guide in your “Documents” tab.

c. What do I need to consider when claiming for orthodontic treatments?

The claiming procedure applicable to your policy will be described in your Benefit Guide.

If you are under one of our standard International Healthcare Plans, the general claiming procedure described in these FAQs will apply to orthodontic claims too, where orthodontic treatment is included in your cover.

Please note that we will only reimburse orthodontic treatment that meets the medical necessity criteria described below. As the criteria is very technical, please contact us before starting treatment so we can verify if your treatment meets the criteria.

Medical necessity criteria:

- Increased overjet > 6mm but <= 9 mm

- Reverse overjet > 3.5 mm with no masticatory or speech difficulties

- Anterior or posterior crossbites with > 2 mm discrepancy between the retruded contact position and intercuspal position

- Severe displacements of teeth > 4

- Extreme lateral or anterior open bites > 4 mm

- Increased and complete overbite with gingival or palatal trauma

- Less extensive hypodontia requiring pre-restorative orthodontics or orthodontic space closure to obviate the need for a prosthesis

- Posterior lingual crossbite with no functional occlusal contact in one or more buccal segments

- Reverse overjet > 1 mm but < 3.5 mm with recorded masticatory and speech difficulties

- Partially erupted teeth, tipped and impacted against adjacent teeth

- Existing supernumerary teeth

In addition we will only reimburse the cost you incurred after treatment has taken place.

This means that, if you are paying for your orthodontic treatment in instalments, you can submit your claims monthly or quarterly (depending on the payment frequency you have agreed with your medical provider).

Please make sure that the invoice includes a description of the treatment received and the treatment dates for the period invoiced.

You will need to send us some supporting information to show that your treatment is medically necessary and therefore covered by your plan. The information we ask for may include, but is not limited to:

- A medical report issued by the specialist, stating the diagnosis (type of malocclusion) and a description of the patient’s symptoms caused by the orthodontic problem.

- A treatment plan showing the estimated duration and cost of the treatment and the type/material of the appliance used.

- The payment arrangement agreed with the medical provider.

- Proof of payment of the orthodontic treatment.

- Photographs of both jaws clearly showing dentition before the treatment.

- Clinical photographs of the jaws in central occlusion from frontal and lateral views.

- Orthopantomogram (panoramic x-ray).

- Profile x-ray (cephalometric x-ray).

- Any other document we may need to assess the claim.

You will find the “Orthodontic treatment” definitions and any applicable exclusions in your Benefit Guide, if you wish to check the level of cover provided to you under your policy.

You can access your Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and check your Benefit guide under the “Documents” tab.

d. What do I need to consider when claiming for “In-patient cash benefit”?

If this benefit is included in your policy, it is payable when you receive inpatient treatment for a medical condition that is covered by us but is free of charge for you, i.e. when the full cost of your treatment is funded by your national health service and no claim is made or paid by us under any section of this policy. In-patient cash benefit is limited to the amount specified in the Table of Benefits and is payable after you are discharged from hospital.

To claim the “In-patient cash benefit”, please follow the general claiming procedure described in the question above regarding “How do I claim for medical expenses that I have already paid for to my medical provider?"

Note that you also need to attach your admission/discharge notice from the hospital when you send your claim to us (via MyHealth Digital Services). The admission/discharge notice must specify the number of nights spent in the hospital and the treatment received and it must confirm that the treatment received was free of charge.

e. How quickly will I be reimbursed for eligible out-patient treatment?

Please note that the claiming process (including our Service Level Agreement) may vary depending on the product available to you and on the type of insurance contract. We therefore advise you to check your Benefit Guide to confirm the claiming process applicable to your policy.

For example, if you are covered under one of our standard International Healthcare Plans, (and as long as your claim is submitted with all relevant details, documentation, invoices and receipts within six months after the end of the Insurance Year) we will aim to process your claim within 48 hours.

Please note that without the diagnosis, we cannot process your claim promptly, as we will need to request these details from you or your doctor. To help us processing your claim in the quickest time possible, please ensure to include the diagnosis, an eligible copy of each invoice and any supporting documentation on your claim.

You can submit your claims via MyHealth Digital Services online or via app and then follow the status of your submitted claims by logging in to your account.

Please note that we will email or write you to advise when your claim has been processed; if you have submitted your claim via post or email, we will also include a settlement letter and a Statement of Accounts.

Payment instructions are sent to our bank at the same time of claim processing, but please note that it can take up to 10 working days for the payment to reach your bank account (as this depends on the bank’s international transaction timelines).

Before you submit a claim it is important to understand your level of cover and the terms and conditions applicable to your policy. For this, please check your Table of Benefits and your Benefit Guide accessible via your MyHealth Digital Services account.

Our Claims Team follows rigorous quality control measures to ensure your claim is processed correctly and efficiently. Nonetheless, there are a few reasons why a claim might be fully declined or partially reimbursed.

Some of the possible reasons why this may happen are detailed below. Please refer to the specific question/answer below for further details.

If you cannot identify your claim with any of the reasons listed you might contact our Helpline for clarifications.

a. What does the “6 month period” refer to in relation to claim submission?

Unless otherwise stated in your Benefit Guide or in your Table of Benefits, all claims should be submitted no later than six months after the end of the Insurance Year. If cover is cancelled during the Insurance Year, your claims must be submitted no later than six months after the date that your cover ended. After this time we are not obliged to settle the claim.

b. My claim was declined or partially paid due to “Duplicate claim”. What does it mean?

If you submit an invoice that has already been processed and reimbursed under another claim submission, we will decline it as a duplicate.

c. My claim was declined or partially paid due to “Benefit limit exceeded”. What does it mean?

If the maximum benefit limit for the benefit you claimed for has been reached, the invoice(s) cannot be reimbursed in full. Please refer to your Table of Benefits and to your Benefit Guide for full details of the benefit limits that apply to your policy.

You can access your Table of Benefits and Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and select the “Documents” tab.

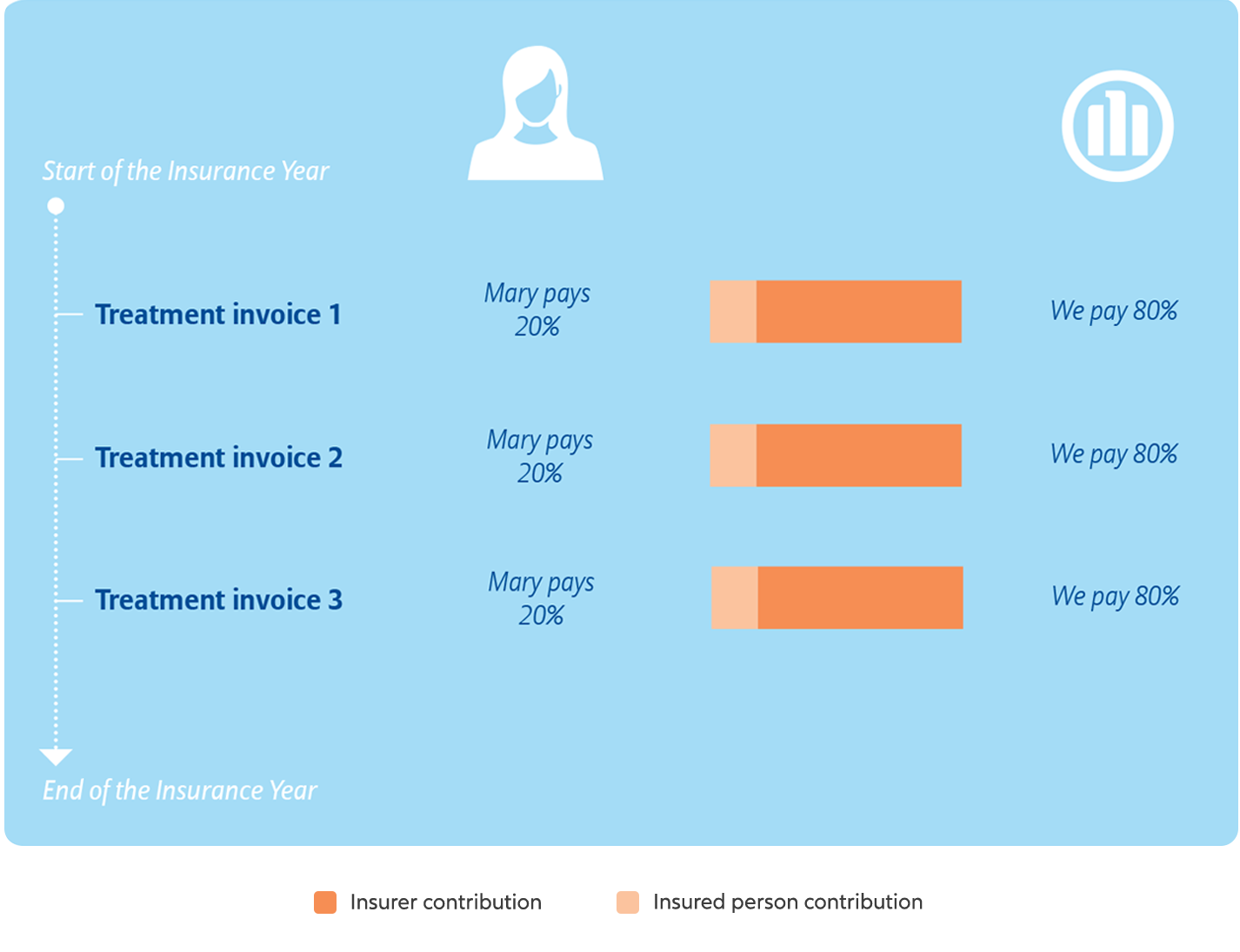

d. My claim was declined or partially paid due to “Co-payment applied”. What does it mean?

If you have a co-payment under your plan, it means that a percentage of the eligible costs incurred are to be paid by you. Normally co-payments apply per person, per Insurance Year, unless indicated otherwise in your Table of Benefits.

Some plans may include a maximum co-payment per insured person, per Insurance Year and, if so, the amount will be capped at the amount stated in your Table of Benefits. Co-payments may apply individually to the Core, Out-patient, Maternity, Dental or Repatriation Plans, or to a combination of these plans. The details of your co-payment are stated in your Table of Benefits.

In the following example, Mary requires several dental treatments throughout the year. Her dental treatment benefit has a 20% co-payment, which means that we will refund 80%. The total amount payable by us may be subject to a maximum plan benefit limit.

e. My claim was declined or partially paid due to “Deductible applied”. What does it mean?

A deductible (also known in health insurance as an ‘excess’) is a fixed amount you need to pay towards your medical bills per period of cover before we begin to contribute. Your Table of Benefits will show whether this applies to your plan. Where applied, deductibles are payable per person per Insurance Year, unless indicated otherwise in the Table of Benefits.

You will find further information about deductibles in the “Understanding how your cover works” and “Additional information about claiming for your expenses” sections of your Benefit Guide.

You can access your Benefit Guide via MyHealth Digital Services. Simply log in via browser or via MyHealth app, click on “My Policy” and check your guide.

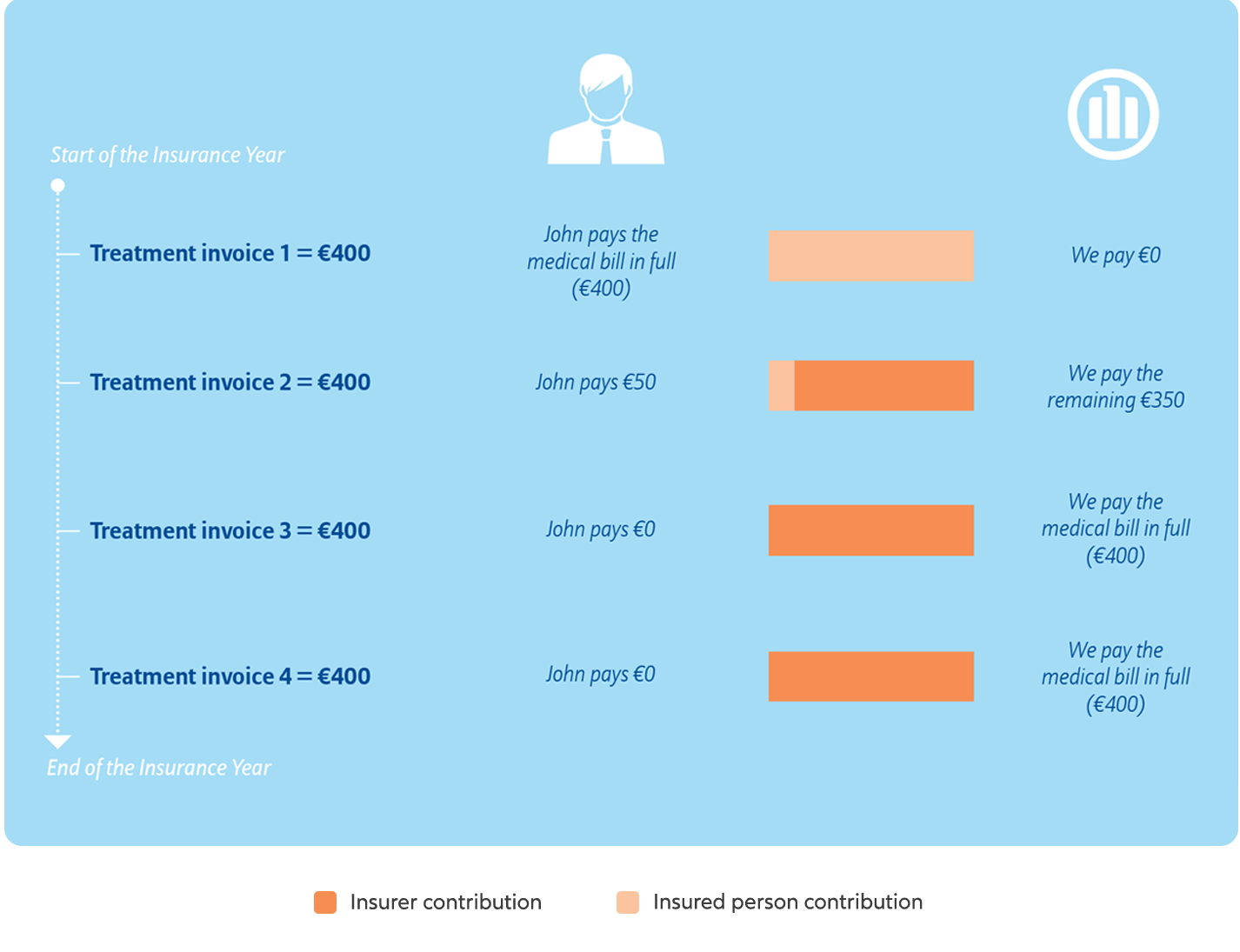

In the following example, John needs to receive medical treatment throughout the year. His plan includes a €450 deductible.

f. My claim was declined or partially paid due to “Excluded under Terms and Conditions”. What does it mean?

Although we cover most medically necessary treatment, we do not cover expenses incurred for certain treatments, medical conditions and procedures under the policy unless confirmed otherwise in the Table of Benefits or in any written policy endorsement.

Please refer to the “Exclusions” section of your Benefit Guide.

You can access your Benefit Guide via MyHealth Digital Services. Simply login via your browser or use the MyHealth app, click on “My Policy” and check your guide.

g. My claim was declined or partially paid due to “No further information received”. What does it mean?

In some cases, upon receipt and initial review of your claim, our Claims Team may request further information necessary to process the claim.

For example, if you are claiming for an orthodontic treatment, we will require submission of a treatment plan. If this information is missing from your claim, we will request it from you.

If the information is not received within two months of our initial request, we will be unable to evaluate and process your claim and therefore your file will be closed. We can of course re-open your claim, provided that this is done before your right to claim expires.

When you submit the missing information requested in relation to your claim, our Claims Team will be happy to complete the processing of your claim according to the terms and conditions of your policy.

h. My claim was declined or partially paid due to “Missing Pre-authorization (MPA)”. What does it mean?

Your Table of Benefits will indicate what (if any) treatments are subject to pre-authorisation through submission of a Pre-authorization Form. Usually these are in-patient and high cost treatments.

Use of the Pre-authorization Form helps us to assess your case and facilitate direct settlement of your bill with the hospital.

The terms related to the Pre-authorisation process may vary slightly depending on the product available to you. For example, if you have one of our standard International Healthcare Insurance Plans, the following applies when a Pre-authorization is required but not obtained:

- If the treatment received is subsequently proven to be medically unnecessary, we reserve the right to decline your claim.

- If the treatment is subsequently proven to be medically necessary, we will pay 80% of in-patient benefits and 50% of other benefits.

i. My claim was declined or partially paid due to “No benefit under your plan”. What does it mean?

Unfortunately, if the benefit you are claiming for is not included under your plan, we are not liable to reimburse your claim.

Please refer to your Table of Benefits and to your Benefit Guide to understand what is included in your cover.

You can access your Table of Benefits and to your Benefit Guide via MyHealth Digital Services. Simply login via your browser or use the MyHealth app, click on “My Policy” and check your documents under the “Documents” tab.

j. My claim was declined or partially paid due to “Over-the-counter drugs”. What does it mean?

If the “Prescribed drugs” benefit is included in your Table of Benefit, cover is provided as stated there for over-the-counter medication that have been prescribed by your doctor.

However, if the “Prescribed drugs” benefit is not listed in your Table of Benefits, over-the-counter medication will not be covered even if you have a prescription from your doctor.

Please check the definitions and exclusions included in your Benefit Guide to confirm this.

You can access your Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and check your guide.

k. My claim was declined or partially paid due to “Waiting period applied”. What does it mean?

Your Table of Benefits indicates if any of your eligible benefits are subject to waiting periods. When a waiting period applies, you will be eligible for cover under that specific benefit when the waiting period has expired; e.g. if your benefit is subject to a six month waiting period, you will start being covered for it after six months have passed from your policy start date (or effective date if you are a dependant).

Please refer to your Table of Benefits and Benefit Guide for full details of the terms and conditions of your policy.

You can access your Table of Benefits and to your Benefit Guide via MyHealth Digital Services. Simply login via browser or use the MyHealth app, click on “My Policy” and check your documents.

When we issue a claim payment, we instruct your bank to charge any applicable transaction fees to us: therefore, your bank should credit the full reimbursement amount to your account. Nevertheless, there may be multiple banks involved in the international transaction of your funds and each of them may charge a fee. These fees vary by bank, country and currency.

We have been advised by our bank, Citibank, that even though we instruct your bank that we pay the charges associated with the claim payment, this does not mean that your bank won’t charge you for crediting your account (as banks handle payments based on their own banking and country rules/policies). To investigate any charges applied to your claim payment, we advise you to first contact your bank.

Afterwards, if you require more clarification, we will be happy to help by setting up a case file to confirm if your payment was processed correctly: in this case, please email us your request and include a document from your bank that states the incurred charges. Also, please provide the claim number related to the payment.

Claim payments are issued by us right after your claim is processed: however, please note that, depending on the bank transaction timelines, the payment can take up to 10 working days to appear in your bank account. If you have not received your payment within 10 working days, we would appreciate if you could re-confirm your bank account details to us.

If your claim was submitted via portal or app, you can check what account details we have used to pay your claim in your Notification of Payment. This is made available to you on your MyHealth Digital Services account. If your claim was submitted via any other channel, e.g. email or post, etc. the Statement of Accounts and Notification of Payment was sent to you by email or post.

If the account details in your Notification of Payment are incorrect, please contact our Helpline to provide your correct bank details and related claim number so that we can investigate your payment for you.

If you opted to receive your claim payment by cheque, please note that cheques might take up to 6 weeks to arrive at your address, depending on the geographic area of destination. If passed this time you still have not received your cheque please contact us, indicate the claim number the payment relates to and confirm your postal address – so that we can check the status of your cheque in the post.

Alternatively, you can ask us to reissue the payment by bank transfer instead. In that case, you will also need to provide your full bank details as stated below:

- Payment currency

- Name of account owner

- Account number

- Sort/branch code and BIC/Swift code

- IBAN code (also required if your bank is within the EU)

- Bank name and address

- Details of intermediary bank (if the payment has to be made via an intermediary) including the bank name, Swift code and account number

- Any additional information required in order to process international transactions within your country (e.g. Agency Code, Tax ID)

We’re are constantly improving our digital tools in an effort to enhance our member experience - We want to make it easier and more convenient for you to manage your claim submissions with us. Find out more about our recent updates.